Venture With Me

Venture With Me invests in inspiring stories with real and sustainable impacts, driven by the bold and the daring. In the next generation of boutique Venture Capital, let us together change the future as partners, investors, consultants and/or advisors.

About Us

Venture With Me is a business ecosystem comprised of partners, investors and businesses designed to operate synergistically. At our core, the extensive industry knowledge and experience supplements the ecosystem surrounding us, while our ecosystem constituents complement each other. Operating under such a model allows us to position ourselves and our constituents uniquely in the market where we can derive additional returns for the ecosystem through:

- Highly efficient investment opportunities

- Synergized deal placements

- Best-of-breed and cost-effective consulting/advisory offerings

- Reduced portfolio risk and increased industry reach with each SME onboarding

- Managed portfolio solutions

Partner

Invest

Consult

Advise

Home Brewery

Coffee Bar

Restaurant

Room Service

24x7 Reception

Car Rental

Hair Dryer

Secure Wi-Fi

Wellness Spa

Fine Dining

In-house Bar

Banquet Hall

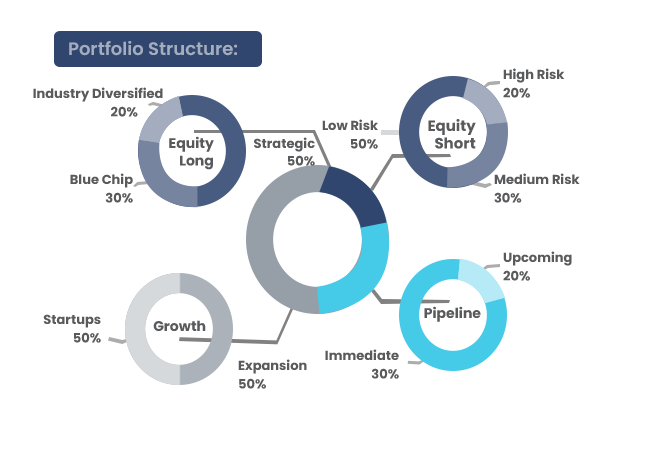

Portfolio Structure

Equity Long

Equity Short

Incorporating strategic enablers in our long term equity positions allows us to take ample risk through our short term equity positions. By doing so, we can ensure that we maintain a safe but strategic exposure to a diverse range of existing and upcoming markets.Incorporating strategic enablers in our long term equity positions allows us to take ample risk through our short term equity positions. By doing so, we can ensure that we maintain a safe but strategic exposure to a diverse range of existing and upcoming markets.

Pipeline

In maintaining a strong offering to our internal ecosystem and expanding our investment horizon, we employ a unique investment model in what we term the workflow pipeline. Through the pipeline we secure internal synergy and external partner opportunities to reinforce the concept of ecosystem scalability and perpetuality.

Growth

At the crux of the network lies our strongest mode of development. Through rigorous due diligence, calculated risk and wholistic ecosystem analysis, we approach businesses with an adaptive and forward-thinking mindset. Using a unique combination of build, blend and retain styled portfolio techniques, we are able to incorporate long-chain hedging across investments to de-risk our multi-year horizon events.

Escape To The Luxury This Summer

Habeo nemore appellantur eu usu, usu putant adolescens consequuntur ei, mel tempor consulatu voluptaria te. Et dicunt qualisque vel, eam ubique mucius docendi ne. Debet decore repudiare id mei, homero iuvaret fastidii ius in, no mei alienum accusata.

Gallery

Portfolio Structure

Equity Long: Building for the long term is paramount in our core strategy. We mix between public and privately held stock inclusive of our partnership network, where the later serves as an enabler for pipeline and growth opportunities.

Equity Short: Incorporating strategic enablers in our long term equity positions allows us to take ample risk through our short term equity positions. By doing so, we can ensure that we maintain a safe but strategic exposure to a diverse range of existing and upcoming markets.

Pipeline: In maintaining a strong offering to our internal ecosystem and expanding our investment horizon, we employ a unique investment model in what we term the workflow pipeline. Through the pipeline we secure internal synergy and external partner opportunities to reinforce the concept of ecosystem scalability and perpetuality.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.